There are a lot of reasons to sell a home. The “right decision” depends on what you value most. For example, you may prefer convenience over maximum offer price. You may need to move on a specific timeline or you might be more concerned about certainty and having control over the process.

We break down some of the key factors to consider when selling your home to an iBuyer. Not familiar with one of the newest ways to buy and sell a home? Start with our iBuyer guide.

1. Net proceeds: how much do you want to pocket?

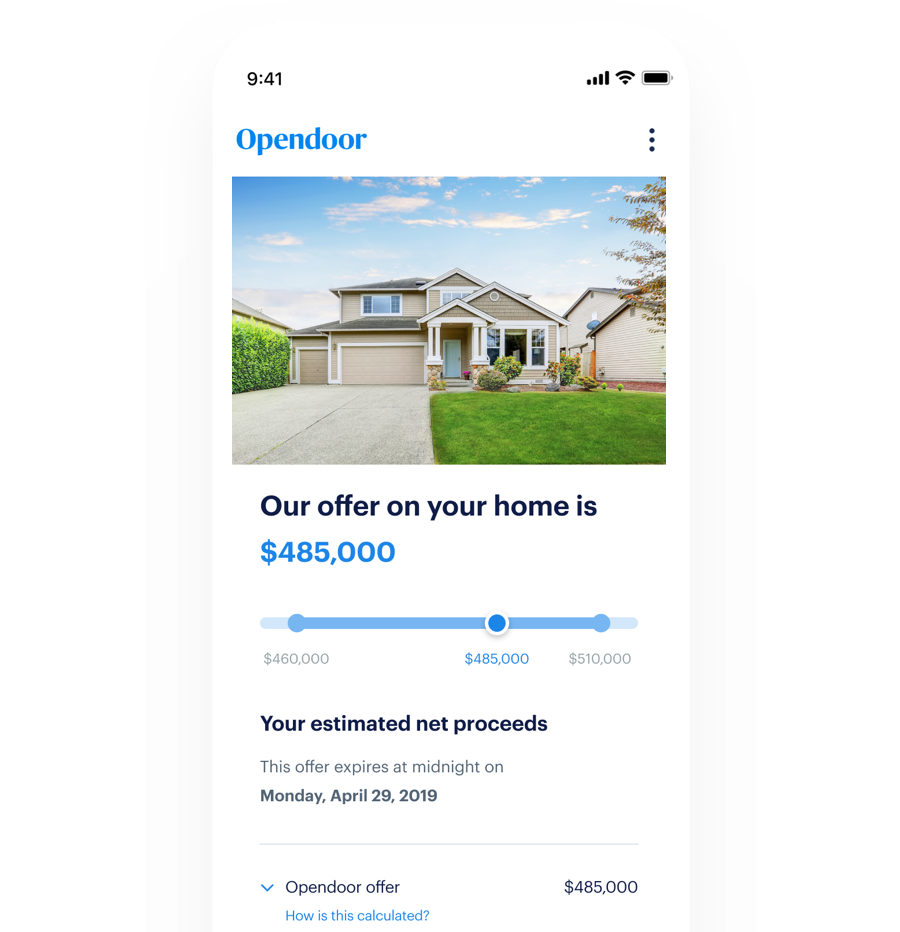

Your net proceeds are the amount of money you receive for your home minus the costs of selling. When thinking about what it costs to sell a home, many people fixate on the standard 4-6% real estate agent commissions. When you factor in additional costs that are common in most sales like repairs, closing costs, and relocating costs, your total expenses can come closer to 10% of the home’s sale price.

Use our home selling cost calculator to estimate what your net proceeds will be. When selling to an iBuyer like Opendoor, the transaction fee varies based on trends in your market and the circumstances of your home.

In some cases, you may have higher net proceeds with an iBuyer, and in others, you may compromise between price and other factors like timeline and convenience. Either way, you can request an offer from us at anytime; it’s free and there’s no obligation to accept.

→ How Opendoor calculates the value of your home

2. Timeline: when do you need to move?

When you sell can be just as important as how much you sell for. Maybe you accepted a new job and you start next month, or maybe you’ve found a great home but you can’t move in for several months.

Often, the costs of a double mortgage, renting during a transition period, or just maintaining your existing home can exceed the value of holding out for a higher offer. The average time it took for homes to sell (also called days on market) in Spring 2018 was 60 days as Forbes reported.

In a traditional sale, the timeline is essentially an agreement between the buyer and seller. You might need to wait for a buyer to qualify for financing or you may have to accommodate a more inconvenient timeline as a concession to the buyer. This is an area where iBuyers offer a lot of value because they can provide more flexibility on when you close. When selling to Opendoor, you receive an offer within 48 hours and close within 10 days or 60 days, you choose.

→ How do Opendoor’s costs compare to a traditional sale?

3. Certainty: what if it doesn’t go as you planned?

In our conversations with customers, it’s clear that much of the stress of selling stems from uncertainty ie not knowing when you’ll find a buyer, if the offer will make it to close, or if there will be any surprises along the way. The traditional process doesn’t always allow that level of transparency because of the challenges of connecting with a buyer directly.

When you accept an offer from Opendoor, you get a break down of your costs and net proceeds, you control the timeline, and you don’t have to worry about financing fall-through. This affords you more certainty so you can focus on the next big thing, like finding a home you love.

→ How does Opendoor differ from Zillow and Offerpad?

4. Convenience: how much do you value peace of mind?

Selling a home can be a lot of work eg months of showings, repairs and maintenance, and of course, navigating the sale itself. Think about your investment of time and energy as an opportunity cost—what would you do if you weren’t focused on selling your home?

iBuyers can offer a simpler experience, allowing you to sell your home without listing on the market. For example, when you sell to Opendoor, we streamline each step of the process, from requesting an offer, to handling any repairs, to closing. We also pair you with a dedicated home advisor so you have someone to assist you through each step.

Happy Opendoor customers: the Rodriguez family from San Antonio, TX, with OD’s General Manager Chris Westrom.

Happy Opendoor customers: the Rodriguez family from San Antonio, TX, with OD’s General Manager Chris Westrom.

How do you choose the right iBuyer?

Every week it seems there’s a new company offering iBuying services, each with a different business model. When starting your research, you’ll want to first explore the cities where an iBuyer operates, and the types of homes they buy. This varies widely.

Next, it’s important to understand their business model and how they make money. You want to be sure the company you work with has an incentive to offer a competitive price and is transparent about their fees.

Once you have a few prospects, here are some useful criteria to compare:

- Experience: How many customers has the company served? How long have they been operating?

- Reviews: Do they have balanced reviews? You can’t expect everyone to have a perfect experience, but it’s reassuring to see positive stories that relate to your situation.

- Comprehensive services: Can they help you address multiple needs? For example, maybe you need help handling repairs before selling or maybe you want to trade-in.

- Value: Does the proposition help you achieve your goals? Sometimes it’s that simple.

See how we stack up to our competitors or read about what our customers have to say.

Related guides and blog articles

→ How does Opendoor make money?

→ How the Opendoor repair and home assessment works

→ Most common misconceptions about Opendoor?