Home Selling Tips

How to sell your house: tips for a smooth sale

Reading Time — 10 minutes

March 8, 2020

Reading Time — 10 minutes

March 8, 2020

Table of contents

Selling your first home isn’t as simple as listing your home on the market. Much like buying a first home, the learning curve can be steep.

We’ll break down the essential steps for selling your home, so you can win over buyers and sell it for the most money – without losing your cool.

Step 1: Decide how you’re going to sell

Choosing how you’re going to sell dictates every other aspect of the process, from the selling strategy, to the cost of selling the home, and the preparation you’ll need to do.

In the digital age, sellers no longer need to list their home with a real estate agent—you have options. But, it’s important to weigh the pros and cons to determine the best fit for your circumstances.

→ Haven’t heard of Opendoor? Learn how we make selling your home easier.

With a real estate agent

The real estate agent (or listing agent) markets the home, prepares the paperwork, and communicates with the buyer’s agent—the real estate professional who assists the buyer with finding and closing on the home. Many sellers choose to work with an agent because they can offer guidance on pricing, incentives, and local market expectations.

For assisting you with the sale, the listing agent will typically charge 5-6% commission (fee varies by location) that then gets split with the buyer’s agent. Keep in mind, there are other costs to selling your home beyond agent commissions.

For sale by owner

With this option (often called “FSBO”), the owner manages all aspects of the sale. Because you are selling the home, you won’t need to pay a listing agent’s commission. In FSBO transactions, the seller has an asking price and can stick to that price, and it is up to the buyer to pay their agent a commission. Alternatively, the seller can negotiate the rate with the buyer’s agent.

Generally the better condition your home is in, the more offers you will receive and the easier it is to justify the price.

While this can save money, it requires more time and effort. All the paperwork and home marketing fall on the seller. You’ll need to handle tasks like listing the property online, taking high-quality photos, writing listing details, and scheduling showings. Knowledge of the local real estate market is also important to accurately price the home.

For many homeowners, especially those who haven’t sold a house, saving money on the buyer’s agent fee isn’t worth the extra effort of handling all aspects of the sale.

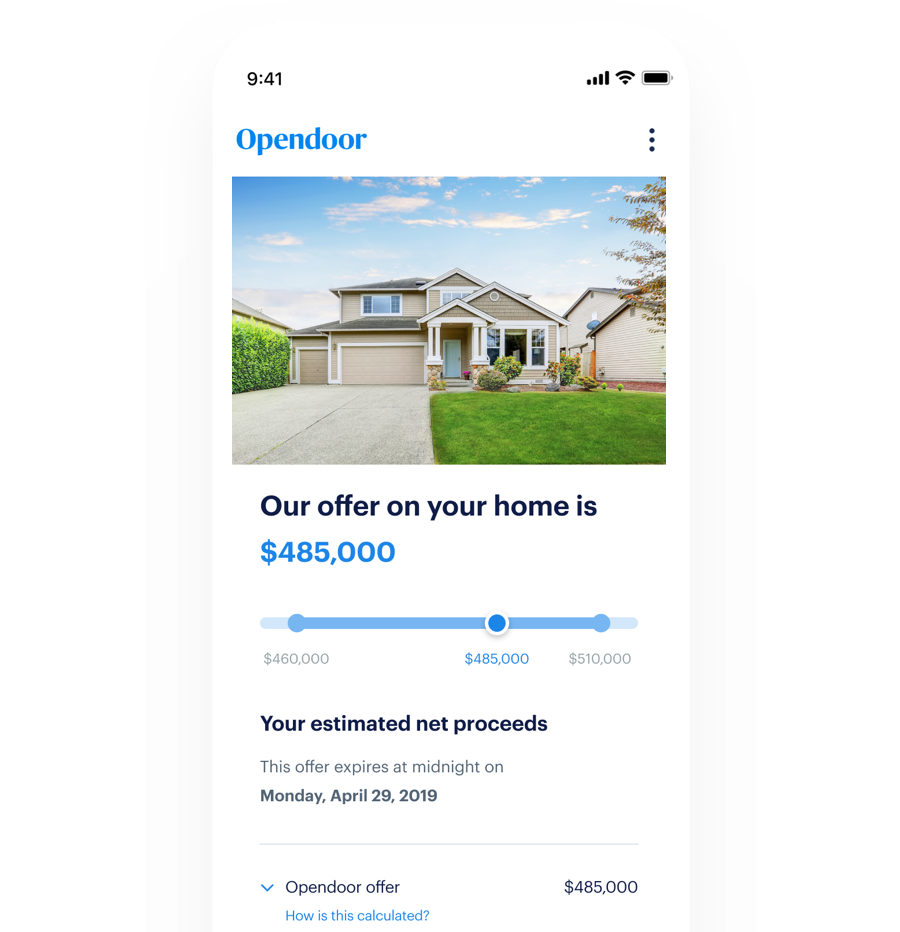

Sell your home to an iBuyer

The traditional process can be stressful—showings, repairs, offers that fall through, and months of uncertainty. Selling to an iBuyer like Opendoor is an alternative way to sell your home that emphasizes convenience and certainty.

With Opendoor, you can receive a competitive offer on your home and then move on your own timeline without listing on the market. This enables you to skip several of the steps outlined in this guide. Unlike a home flipper that’s investing in undervalued homes to maximize price appreciation, Opendoor makes a competitive offer on houses that are in good condition.

For our services, we charge a service fee similar to the commission a real estate agent collects in a traditional sale.

→ Compare the costs of selling to Opendoor versus a traditional home sale.

Step 2: Determine your asking price

Pricing your home requires a balance between personal expectations and market conditions. How you price your home can mean the difference between an offer and weeks or even months on the market.

Online tools can provide an estimate of your home’s value. The traditional way to value a home is to manually select a few comparable homes or “comps” that have recently sold in your area. It’s extremely difficult to find a perfect match so you, or your agent, will need to make adjustments. For example, if your home has three bedrooms but a comp has four, how much would the comp have sold if it had three? This gets even more challenging with features like pools, vaulted ceilings, and a mountain view.

Opendoor uses current market data to analyze hundreds of comparable homes along with info uploaded by the seller to make a real offer in just a few days.

→Learn more about how Opendoor calculates the value of your home.

Once you have a good idea of your home’s value, consider whether time or money is more important. You might price a home more competitively if you want to move quickly; on the other hand, you may choose to endure weeks or months of showings for a higher price.

Read our in-depth blog post on how to determine the value of your home and learn more about all the factors you should take into account when assessing how much your home is worth.

Step 3: Prepare your home for sale

Generally the better condition your home is in, the more offers you will receive and the easier it is to justify the price. Here are a few steps you can take to get your home in top condition before showings:

Declutter

This is an important component of preparing a home for sale, as decluttering is the best way to make your home look clean, spacious, and ready for new owners. Consider your home from a visitor’s perspective — does it feel expansive and welcoming? Clear countertops, shelves, closets and corners where items have accumulated. Consider additional storage options if necessary to keep the home clear.

→ On a timeline? Read our in-depth guide on how to sell your house fast.

Decor

Decor, for selling a home, means making the space as neutral as possible — no funky accessories on the walls or overpowering colors. Neutral colors, for example, offer potential buyers a blank slate so they can imagine themselves in the home.

Maintenance

Make a plan for maintenance, so nothing falls through the cracks during the hectic home-buying and selling process. This way, your home remains in pristine condition until it’s under contract.

This includes lawn care, small fixes, and annual upkeep such as changing the HVAC air filter or flushing the hot water heater.

Step 4: Market and list your home

If you work with a real estate agent, he or she will list your home on the MLS database and (typically) market your home by doing the following:

Coordinating professional photographs

Posting signage in the yard

Hosting a broker/agent showing

Organizing an open house

Choosing the for sale by owner option means the owner does all of the above. The most important part is getting the home onto the MLS, which feeds other real estate search engines.

Most agents review the MLS for new listings daily. A FSBO seller will be able to list on the MLS through a service by paying a flat fee.

Step 5: Show your home

Showings are a vital part of the selling process. The more people who tour the home, the more likely you are to receive an offer. You may need to allow buyers to come through, even when the timing isn’t convenient.

Showing your home means keeping it extra clean, tidying at a moment’s notice, and vacating the property so potential buyers can tour without distraction.

Step 6: Review offers and negotiate

If a buyer likes the home, he or she will make a formal, written offer. The offer is submitted by the buyer’s agent to the seller’s agent, or directly to the seller for FSBO transactions. Whether you have one or multiple offers may affect the considerations below.

Top things to consider in a home offer beyond the offer price

Buyer pre-approval: An offer should come with a pre-approval letter and proof of funds. These documents are strong indicators that your buyer can obtain financing for their mortgage, and will be able to close on the home.

Closing costs: Buyers may ask for closing assistance, which is a specific dollar amount at closing to assist with closing fees.

Seller concessions: Seller concessions are additional financial incentives sellers provide to buyers. Seller concessions can include additional money to cover things like inspection fees, title insurance, origination fees, or homeowner association fees for the first year.

Cash vs. financing: In a multiple-offer scenario, an all-cash offer is more competitive because the buyer doesn’t need bank financing. Without the bank involved, closing can happen in a matter of days.

Buyer’s contingency: This is a clause in a home sale contract that states the buyer can only buy the house after the sale of their current property. Many sellers accept offers with buying contingencies, but again, in a multiple-offer scenario, an offer without any contingencies is usually viewed as more competitive , since the sale of the home isn’t predicated on the sale of another.

Timeline: Some buyers may want an extended closing date — perhaps they’re moving for a job, or juggling school schedules, or their offer is contingent on the sale of their home. If you have other, similar offers, you may prefer a buyer better suited to your timeline.

Step 7: Accept offer and close the deal

Due diligence and underwriting

Once an offer is accepted, the home comes off the market and the buyer is allowed to do due diligence to inspect the home and ensure they’d like to move forward with the purchase. After the due diligence, the buyer must then obtain financing for the home, known as the underwriting period. During this time, the bank will inspect the buyer’s financials and the home under contract to ensure those buyers are good candidates for the mortgage loan.

Sign title and escrow documents

You’re almost there. All that’s left is for you to sign your title and escrow documents. Be sure to bring a valid photo ID with you when you sign. Following close of escrow, documents showing that the seller now owns the house will be recorded in public records. You’ll be wired your money, and the sale will be complete. Congratulations, you made it!

Step 8: Move to your new home

Many homeowners can’t purchase something new until they sell their current home. If you sell directly to a company that buys homes with their own capital, you don’t have to worry about these types of contingencies or other hangups, and you can begin shopping for your new home. If you’re counting on the sale in order to afford a new home, you’ll know exactly how much money you have to work with, instead of just estimating what your home might sell for.

With an agent or for sale by owner process, sellers have a lot more unknowns. In this scenario, you may want to look for a new home before yours is sold, which can be tricky since you may not know your exact budget or move-out date. It’s also a lot of work to look for a new home while selling another. Of course, some people have the finances to purchase a new home before selling their current one, but that’s not always the case.

Takeaways

At the end of the day, home selling is really about determining your priorities and which selling strategy will help accomplish those goals. One of the best things you can do to help sell your home quickly is prepare your home to make a great first impression.

By Lauren Bowling

This article is meant for informational purposes only and is not intended to be construed as financial, tax, legal, real estate, insurance, or investment advice. Opendoor always encourages you to reach out to an advisor regarding your own situation.